Overview

This article provides an overview on how revenue recognition is configured in LogiSense Billing.

Prerequisites

In order to determine the proper revenue recognition implementation we will work with you to evaluate your current systems and how to integrate them with LogiSense Billing. Some key aspects of this are:

If a CPQ/CRM system in use and if it's applicable to the revenue recognition configuration

What ERP is in use and what automation capabilities are available

What are the reporting levels and field mapping requirements within the ERP

Determining if there are any custom rev rec rules that are required outside the standard rules provided in LogiSense Billing

Configuration Process

In this document we will focus on the three standard report types provided when revenue recognition is configured in LogiSense Billing:

Recognized Revenue

Deferred Revenue

Accrued Revenue

Additional customizations are available to these reports and additional custom reports can be setup for revenue recognition purposes if required. The standard frequency for these outputs is scheduled monthly or at the end of your fiscal month.

Reports can be accessed in the AdminPortal (LogiSense Billing UI), delivered to a transfer location that you specify (S3 bucket/SFTP), or directly accessed by API integration with your ERP.

LogiSense Billing Configuration

Within the LogiSense Billing application you can define how revenue is recognized for every service configured in the system using rev rec rules (detailed below). How revenue is recognized for one service can differ from another service based on the rule you define on each service.

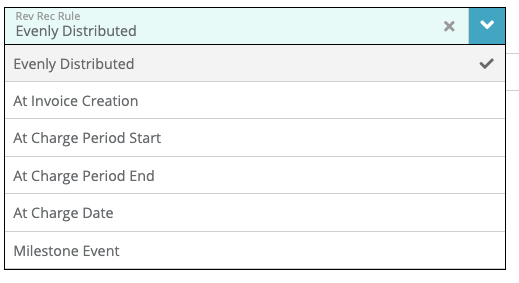

Rev Rec Rules

Rev Rev Rules are configured on custom fields in the system and allow you to define how revenue should be recognized according to your needs. The custom field is configured on the product sold (service).

Standard rules required plus any custom defined rules from prerequisite discussions will be configured ahead of time before the report configurations are finalized.

Available Rules:

Evenly Distributed: this option will take the total price for the service and divide it evenly across the length of the term/contract period. For example, an annual product with a price of $120 would be recognized at 1/12th ($10) per each fiscal month

At Invoice Creation: service revenue is deferred until the first invoice is generated. Once the invoice is generated the revenue is recognized. Typically this would be used when finalizing a shippable product or switching from a trial service

At Charge Period Start: recognizes revenue when the service’s effective date is reached. When the effective date is reached even if the service has not yet been billed it will be recognized. Until the service’s effective date is reached it will remain as deferred

At Charge Period End: recognizes revenue when the service’s period end has been reached. The period end is determined by the billed invoice item or the end of the contract associated with the charge/term of the service fee

At Charge Date: revenue is recognized when the service is charged (billing is run)

Milestone Event: This option leverages additional custom fields or status changes (service status change, some other entity’s status changes, etc.) to know when a key deliverable event has been reached. Our implementation team will work with you to determine the best configuration to enable the system to track your milestone events

Standalone Selling Prices

To determine the standalone selling price (SSP) the pricing configured in the LogiSense Billing Product catalog is used. Specifically, the pricing set the package frequency level. If a discount were to be applied to a service the SSP would still be calculated using the prices defined in the catalog, unless custom rev rec rules were defined or a reporting process was configured to exclude this.

Revenue Recognition Reports

Numerous custom reports can be configured in LogiSense Billing to suit your needs, below the standard revenue recognition reports are described.

Recognized Revenue Report: displays revenues from the period that are associated with GL accounts for Recognition. The format of this report is dependent on each customer's specific needs

Deferred Revenue Report: displays any new deferred revenue based on sales orders/contracts within the fiscal month as well as any adjustments to deferred revenues related to recognition and or pricing/cancellation adjustments

Unbilled Revenue Report: any non-contractual accrued revenue such as revenue for usage will be summarized and outlined on this report

Auditing

All changes to pricing, contracts, service state and invoicing are all traceable and reportable for auditing purposes in the Audit Log found in the Operations menu. For example, our audit log can show who changed pricing on a contracted service and to what value from its initial state.