...

Navigate to the Setup / Finance / Taxes / Tax Codes screen

Click the

button in the Tax Codes panel to add a Tax Code

button in the Tax Codes panel to add a Tax CodePopulate the tax code details. In this example we are specifying that the Tax Vendor is native (LogiSense) and that the tax is applicable to the Country of Canada. The tax is applicable to all services and types of accounts so the ‘Service Tax Category’ and ‘Account Tax Category’ are not populated

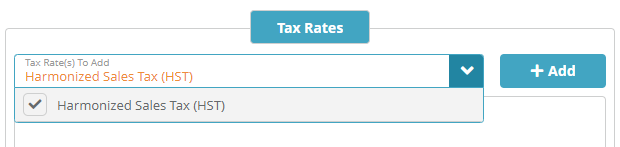

Under the Tax Rates tab select the HST tax rate that was setup previously and click then click +Add.

Click Save to setup the tax code

...

Accounts that are setup with a Service Contact that is located in Canada will charged a 13% tax on all non-usage based transactions (a fee, a monthly recurring charge, etc.).

Tax on a Credit

Account / Billing / Credits

Adding a credit will apply the taxed amount immediately. As shown below a $100 charge applied $13.00 in tax and increased the credit value to $113.00 CAD.

...

Tax on a Transaction

Account / Billing / Transactions

Adding a manual transaction will apply the taxed amount when the account is billed. The image below shows the credit applied above and a new $200 transaction. No tax is applied to the transaction (One Time Charge) .Todo: demo taxation result.because billing has not occurred yet.

...

Once billing is performed on the account taxes will be applied to the One Time Charge transaction. As shown below the $200.00 transaction now has $26.00 in taxes applied.

...