Summary

This guide covers the process of configuring the Local Taxtaxation using LogiSense native tax functionality. This guide will demonstrate how to add a single tax (HST), which will be applicable to all charges which are not usage based in Canada.

Prerequisites

If you wish to apply taxes to specific Countries and States, then Countries will need to be configured. See the Regional Setting Configuration Example article for a walkthrough on how to setup countries and states

Configuration Steps

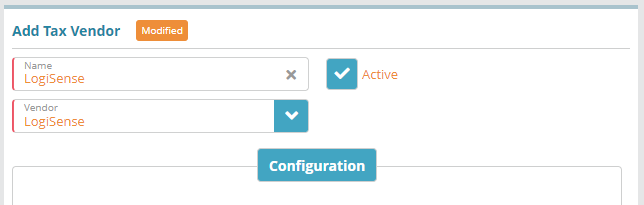

Configure the Tax Vendor

Navigate to the Setup / Finance / Taxes / Tax Vendor screen

...

Click the

button in the Tax Vendor panel and then add a LogiSense Tax Vendor

button in the Tax Vendor panel and then add a LogiSense Tax VendorClick Save to setup the tax vendor

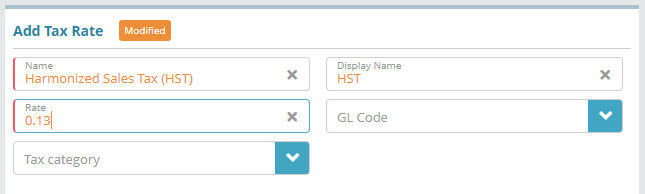

Configure a Tax Rate

Navigate to the Setup / Finance / Taxes / Tax

...

Rates screen

Click the

button in the Tax Rates panel to add a Tax Rate

button in the Tax Rates panel to add a Tax Rate

...

Name: Required

DisplayName: Not Required

Rate: Required

GL code: Not required

...

Populate the tax rate details. In this example we will will setup a tax with a 13% tax rate

Click Save to setup the tax rate

Configure a Tax Code

...

Navigate to the Setup / Finance / Taxes / Tax Code screen. The following fields will appear on the screen.

Name: Required

DisplayName: Not Required

Tax Vendor: Required

Service Tax Category: Not required

Account Tax Category: Not required

Country: Not required

State: Not required

Option Only Report Tax: Not required.Can be configured as needed

Option Tax Usage Only: Not required. Can be configured as needed

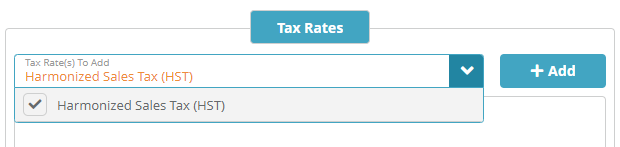

Tax Rate

Select the Tax Rate from the dropdown list and add to the Tax code.

Note: Transactions are taxed based on the Rate attached to the Tax code

...

Related Guides

Codes screen

Click the

button in the Tax Codes panel to add a Tax Code

button in the Tax Codes panel to add a Tax CodePopulate the tax code details. In this example we are specifying that the Tax Vendor is native (logiSense) and that the tax is applicable to the Country of Canada. The tax is applicable to all services and types of accounts so the ‘Service Tax Category’ and ‘Account Tax Category’ are not populated

Under the Tax Rates tab select the HST tax rate that was setup previously and click then click +Add.

Click Save to setup the tax code

Result

Accounts that are setup with a Service Contact that is located in Canada will charged a 13% tax on all non-usage based transactions (a fee, a monthly recurring charge, etc.).

Todo: demo taxation result.